Actual connection times and availability may vary. to 6 p.m., ET, Monday to Friday (except holidays). After May 1, English and French hours of operation will be 9 a.m. ET for French during tax season (from February 20 to May 1, 2023). to 12:00 midnight ET, 7 days a week for English, and 9 a.m. TurboTax experts are available from 9 a.m.All prices are subject to change without notice.

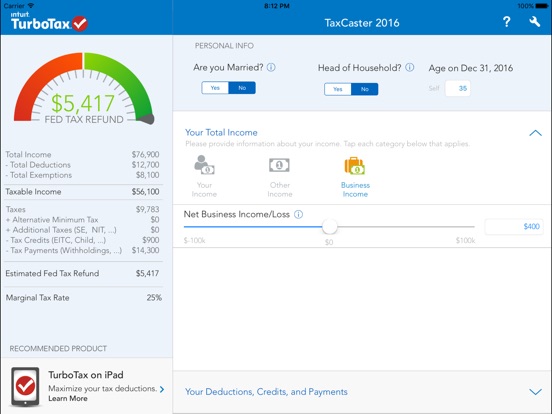

TurboTax Online prices are determined at the time of print or electronic filing.Includes field audits through the restricted examination of books, but does not include the "detailed financial audit". Does not include GST/HST and other non-income tax audits and reviews unless the issues are ancillary to the income tax review itself. Internet connection and acceptance of product update is required to access Audit Defence.Over the past 5 years, more than 24M returns have been electronically filed (using NETFILE) with TurboTax based on CRA NETFILE reporting.Support availability subject to occasional downtime for systems and server maintenance, company events, observed Canadian holidays and events beyond our control. Intuit reserves the right to limit each telephone contact. For Basic, Standard, Premier, Home & Business, Deluxe Online, Premier Online, and Self-Employed Online, technical support by phone is free.TurboTax also offers its TaxCaster, a free tax refund calculator app for iOS and for Android. If I had to point you to one tax calculator, I'd go with TurboTax for the sliders its calculator provides for easy data entry. And both seemed to be fairly accurate their estimates were within $1,000 of one another and also close to what I paid last year in taxes.

I played around with a handful of tax calculators and found those from H&R Block and TurboTax to be the most thorough and easy to use.

0 kommentar(er)

0 kommentar(er)